Get the funding you need for DSCR, Fix & Flip, Ground Up Construction, Bridge Loans, and more.

Easy DSCR Funding for Rental Properties

No Income Docs Required!

Get Approved for Loans Starting at $150K—Competitive Rates and Fast Closings!

Simple application process

No Income Verification Required

As Little As

15% Down

FAST & EASY PROCESS

Designed For Real Estate Investors

Faster Closing Times

Close in 2-4 Weeks

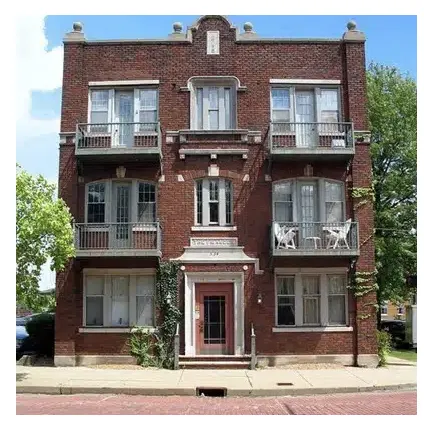

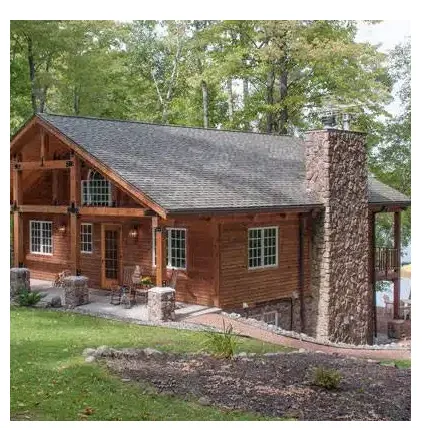

Covers All Types of Rental Investment Properties

Whether you’re investing in single-family homes, multi-unit buildings, or vacation rentals, our loans cover all property types, giving you the freedom to expand your portfolio as you see fit.

Rental portfolios

Commercial Properties

Airbnb & VRBO

OUR PROCESS

How It Works: Simple, Fast, and Transparent

STEP 1

Apply Online

Fill out our short application form with your basic information and loan needs. It only takes a few minutes.

STEP 2

Talk to a Loan Specialist

Once we receive your application, one of our experienced loan specialists will contact you to discuss your options and next steps.

STEP 3

Get Pre-Approved

After a quick review of your financials and property details, you’ll receive a pre-approval, giving you a clear understanding of your loan terms.

STEP 4

Funding in 2-4 Weeks

Once your application is approved and the necessary property appraisal is completed, you can expect funding typically within 2 to 4 weeks.

Facing challenges funding your next flip?

We make it quick and hassle-free to secure the capital you need.

Specialized DSCR Loans

DSCR loans are designed for real estate investors that own rental properties.

Short term rentals like Airbnb properties are the fastest growing type of DSCR loans.

You can obtain a DSCR loan through an LLC. Many real estate investors prefer using an LLC for such loans to separate personal and investment finances, and for potential liability protection. However, lenders may have specific requirements for LLCs, such as the LLC’s age, structure, and financial history. It’s advisable to discuss with the lender and a legal advisor to ensure compliance and to understand the implications of taking a loan in the name of an LLC.

Don't worry, we can help!

Our Products

Types Of Loans

DSCR Loans

Financing based on the income-generating potential of their properties.

Fix and Flip

Financing for property purchases and renovations.

Ground Up Construction Loans

Financing for new construction projects.

Bridge Loans

Short-term financing for real estate projects.

Single Property Rental Loans

Long-term financing for individual rental properties.

Rental Portfolio Loans

Financing for multiple rental properties

within a portfolio.